“Below is an email Dr. Hovind sent which details all the violations of law that were perpetrated against him in order to put him in prison and keep him there. It just goes to show how unjust our so called justice system has become. A lot of inaccurate information has been put out regarding his case, read this and know the truth.” Admin

NEWS ALERT!! After Dr. Kent Hovind of www.drdino.com fame went to prison in 2006 over tax related issues there was a LOT of bad and false publicity about him, the Creation Science ministry and Christianity in general. Most folks talked and wrote about him without knowing the truth of his case or his charges! Below is a Complaint he just filed against the U.S. Attorney in his case. It explains the issues and the real truth about this bizarre case better than anything I have seen. The Complaint refers to 4 Exhibits. These are all posted on www.2peter3.com along with many other documents that will “set the record straight” about who really broke the law in this case! (It WASN’T Kent Hovind!)

Dr. Hovind has also recently filed a Tort claim for damages, a Bivins suit against the BOP employees in S. Carolina who kept his legal files for 20 months after he was transfered out making his appeal late and he has filed an appeal about the “Tax Court” having a trial and finding him guilty without him even being there or knowing what was going on!

He also keeps updates and blogs on 2peter3 and answers questions from skeptics and atheists who are brave enough to write in. He has written 34 books from prison. Some are posted there as well.

The gross injustice in this case should wake Americans up to the real state of their “Justice” system. Unless Congress starts impeaching judges who don’t rule by the Constitution the situation will only get worse. If you have questions or comments for Dr. Hovind you can email him dr.dino@2peter3.com

12-19-2013

To: Clerk of the Court

Complaint to the federal Bar of this Court

Alfred A Arraj US Courthouse

901 19th St. 2nd floor

Denver, CO 80294

From: Kent Hovind #06452-017

FPC Box 9000

Berlin, NH 03570

Re: Attorney Michelle Heldmyer’s (bar #616214) unethical actions and misconduct in U.S. v. Kent and Jo Hovind, Fed Case #3:06cr83 mcr.

1. I am Kent Hovind, born Jan. 15, 1953 in Peoria. IL. I have first hand knowledge to the truth of this complaint.

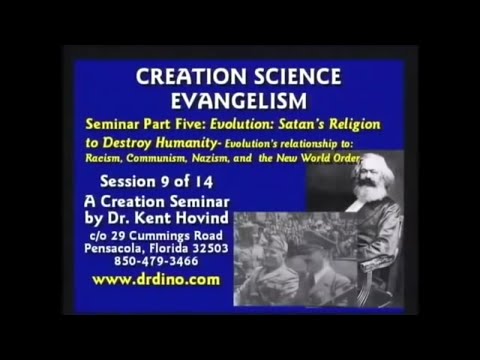

2. I have been a Christian since Feb. 9, 1969 and an ordained Baptist Minister since May 25, 1974. I have been involved full time as an evangelist since 1989 in the Creation Science Evangelism (CSE) Church ministry in Pensacola, FL www.drdino.com. As an evangelist I traveled to all 50 states and over 30 foreign countries defending the Bible as being scientifically accurate against various evolutionists and atheists. I have done 100 debates on the topic as well at various universities. My wife of 40 years and three married children and 5 small grandchildren all live by me and work in the ministry as well.

3. Starting in about 2003 Pensacola based Assistant US Attorney Michelle Heldmyer led a team of attorneys and IRS agents targeting this conservative ministry. They finally got an indictment against both my wife and I on July 11, 2006 on three totally bogus charges as explained below by using lies, deceit and withholding exculpatory evidence. One of the AUSA’s on the team, J. D. Roy Atchison was arrested after my trial while going to Detroit to have sex with a 5 year old. He hung himself in his jail cell on October 5, 2007. More in paragraph #28 below.

4. Every aspect of this case is being appealed but it is her misconduct that I am filing this complaint about. As an AUSA she is not just a lawyer trying to win a case. She represents a sovereign, one of the greatest nations in the history of the world. As a minister of justice she has a duty to insure that I, as a defendant, am accorded procedural justice under the very Constitution that not only gives her power and authority and a job but that she also swore to uphold. See highlighted portions from the Supreme Court case Exhibit #1 at [9].

5. In spite of this clear, well defined and long established duty of hers, before and during my trial she was deceitful, dishonest and deliberately withheld exculpatory evidence of my innocence from the Grand Jury, the Petit Jury and the court. Her actions were more than just unprofessional, they were unethical and malicious. Rather than answer my plea for help and answer the questions I sent to her (See Exhibit #2 p. 2) she caused great damage to me, my family, the ministry God has called me to and my reputation by her deception and dishonesty. She also violated my Constitutional rights as explained below.

Here are the details:

6. In 2005 a Grand Jury was convened to try to get an indictment against me. When I learned of this through friends of mine that were called to testify before the Grand Jury I sent letters and two sworn affidavits to the Grand Jury and asked that I be allowed to come to defend myself before charges were brought dragging me into a very expensive court case which statistics show the government wins 99+% of the time. The US Attorneys have a long standing joke that they can indict and imprison a ham sandwich if they wish to. Attorney Heldmyer did not allow the Grand Jury to receive my letters or affidavits or the exculpatory evidence I had sent the Grand Jury even though I also sent her a copy each time. All this was nearly a year before the indictment. She has never responded either.

7. I sent the first affidavit with my long time friend Ernie Land since he had been called to testify. He handed the affidavit to the Grand Jury foreman but Michelle Heldmyer took it away before they left the room or had time to read it. She was upset that the Grand Jury members might see evidence of my innocence. As she was leaving the Grand Jury room one of my staff members who had also been called to testify heard her say as she walked by, “I didn’t want them to have this information.” (Exhibit #1 p. 1) The staff member also noted that no one in the Grand Jury was carrying any paperwork as they left even though Ernie had handed it to the Forman. You may verify this from Ernie Land 850-956-2031 docfog@docfog.com.

8. On September 15, 2005 I mailed a third sworn affidavit (exhibit #2**) to the Federal Courthouse in Pensacola addressed to the Grand Jury Forman. I included a self addressed stamped envelope and asked for a reply. I never received a reply because Michelle Heldmyer did not allow them to receive it or read it. She violated my First Amendment right to be heard and my 5th Amendment right to due process by not only refusing to let me testify on my behalf but also by withholding from them the fact that both I and my attorney had requested that I be allowed to testify. She also withheld all evidence of my innocence as we will see below. As an attorney sworn to uphold the very Constitution that gives her a job and authority this was clearly an abuse of power on her part. (**I’m sorry the attached copy is so marked up. There is a signed clear copy in the records to the case as well as on www.2peter3.com)

9. Please read exhibit #2 carefully as it lays out the history of the IRS targeting my ministry. This was sent to her three times nearly a year before the indictment and she has never answered any of my questions or points in the affidavit.

10. After one Grand Jury session she told my attorney, Michael Rollo of Pensacola, that the investigation had been “indefinitely postponed” (Exhibit #2). She then convened another Grand Jury and deceived them into issuing an indictment by calling no witnesses and withholding all the exculpatory evidence that had been sent to the previous Grand Jury.

11. Attached to my 3rd Affidavit (Exhibit #2) were letters of about 10 pages each from three different tax professionals that I had paid to review the CSE ministry to insure I was obeying all tax laws that applied. IRS booklet #517 says I am to ask an IRS enrolled agent, an attorney and a CPA if I have any questions. That is exactly what I did. Each professional- an IRS enrolled agent, an attorney and a CPA examined my ministry and stated clearly that I was violating no law and owed no tax. The IRS’s own record showed that as well as we will see below in paragraphs #30-#34.

12. I sent the three professional letters to IRS/CID agent Scott Schneider and AUSA Michelle Heldmyer and said, “Please review these letters and tell me if they are in error. If I do not hear from you within 30 days I will presume that I am being properly advised by these professional and that the investigation has been dropped.” All this was done nearly a year before the indictment. She never answered and Agent Schneider admitted at trial he had never answered a single letter I had sent him. Attorney Heldymer had all this exculpatory evidence for nearly a year yet misled the Grand Jury and later the Petit Jury by maliciously withholding it. She violated her duty to insure that I received procedural justice by seeking an indictment knowing I was innocent and then again by not demanding that Agent Schneider’s testimony be stricken and the case dismissed.

13. She deliberately misled and confused the Grand Jury to get a 58 count indictment on three issues:

14. Issue #1 involved 12 counts of failing to withhold and pay over a tax. As a trained and licensed attorney she knew that in order to have a legal income tax assessment a certified individual or company tax assessment record must be prepared by the IRS on or with form 4340, including a Form 2866-Certificate of Official Record. She knew the government had not done an assessment or issued those forms so there was no evidence I had failed to pay any tax. She misled the Jury and never told them these forms are required.

15. It is well known that the IRS Code is a bewildering maze of legalize that most average people have no clue how to navigate. The average citizen trusts attorneys to know what the law says and they especially trust the United States Attorneys to know and follow the law! She misused her position and prestige to lead the Grand Jury to issue an indictment on counts 1-12 even though these counts have the missing fact elements required before a tax liability can be due and owing.

16. She also knew from the facts presented in Exhibit #2 p. 8-10 that I was an ordained minister and was clearly an exception to the tax or withholding requirements she was charging me with. She misused her position and deliberately withheld this evidence in violation of her duty to insure I received procedural justice. I’m a preacher not a lawyer. I had done all the law asked of me, paid for professionals to review my ministry, sent her their findings and asked her to tell me if I was wrong but rather than answer my simple honest questions or even showing this to the Grand Jury she deceived the Grand Jury into indicting me.

17. Issue #2- She misused her prestige and power and failed in her duty again by deceiving the Grand Jury into indicting both my wife and I on the second issue involving counts 13-57. These 45 charges were about “structuring funds” to avoid a reporting requirement the bank has on transactions over $10,000. She knew that in order to violate the laws she wanted to charge us with she was required to charge and then prove beyond a reasonable doubt that we had willfully violated ALL three provisions of the law. She knew full well that we had not violated the law so she deceitfully only charged one of the three elements as shown below.

18. As a licensed attorney she knew the court lacks jurisdiction if the indictment is missing essential elements (as mine was clearly missing A and C below) but she misled the Grand Jury and later the Petit Jury and the court by only presenting one element as if that is a crime by itself. In her misguided zeal to get a conviction by any means she violated her duty to insure my wife and I received procedural justice on these 45 counts.

19. In order to be found guilty of violating the law (Title 31 USC 5313(a), 5324 (a)(3) and 31 CRF 105.11) we should have been charged with, and it should have been proven beyond a reasonable doubt that we knew about and willfully violated these duties:

A. The duty of an individual to inform the bank or the IRS that he is engaging in multiple but related transactions in order to avoid the CTR requirement.

B. There were multiple related transactions performed by the individual.

C. The multiple related transactions were not filed with the bank or the IRS by the individual.

20. Over the years our ministry had purchased several older homes in the neighborhood for staff housing. We often hired college students part time to help us remodel them. It was easier to give them cash to go get materials as needed. My wife would withdraw cash about every two weeks (if we had it) for this purpose. Pastor Mooneyhan had told us to try to keep withdrawals under $10,000 if possible. At least 4 times she withdrew over $10,000 and the bank filled out the CTR. We finally got credit cards and stopped using cash in 2003.

21. In her misguided and malicious zeal to get a conviction rather than do her duty of insuring justice was done, nearly 3 years later she charged these legitimate cash withdrawals of ministry money over a period of 2 years from a ministry account we had used for 10 years to pay legitimate ministry bills as a crime or “structuring!”

22. None of the withdrawals were related to any other and they were certainly not on one day but rather averaged 12 days apart. There is no law against taking your own money out of your own bank to pay your own bills! Using her twisted logic, if this case is not overturned anyone who takes $200/week of their own money from their own bank for a year will be guilty of 52 counts of “structuring” and could be sentenced to 260 years in prison at 5 years/ct.

23. The law that created this bank duty (the person making the transaction has no duty to file any report) was enacted to prevent drug dealers from moving large amounts of cash. The government wanted to know when anyone deposited over $10,000 in one day. To avoid this report drug dealers simply made multiple transactions of less than $10,000 on the same day. I will be 61 soon and have never taken drugs or tasted alcohol and there was certainly no drug money in our case or bank account. Attorney Heldmyer knew she could never convict my wife and I if she followed the law and was required to prove us guilty of willfully violating all three essential elements of the law so she deliberately and maliciously left out A. and C. from the indictment to mislead and deceive the jury.

24. At the close of the prosecutions case my attorney advised me to not even give a defense since it was obvious we had broken no law. He was reading the jury instructions which everyone, including Attorney Heldmyer had already agreed to-that in order to be found guilty the amount of money “structured” had to be TWO or more related transactions of LESS than $10,000 that totaled MORE than $10,000 on ONE DAY. Attorney Heldmyer suddenly realized that the jury could clearly see that we had never done that so she stood and objected to her own jury instruction. Judge Rogers called for a recess and returned with a new jury instruction that changed the law and said words to the effect, “If you find the Hovind’s withdrew LESS than $10,000 you must find them guilty of structuring.” *** Both my attorney and my wife’s attorney objected but were overruled without reason and even though she knew this was not what the law said Attorney Heldmyer did not object. She violated my Constitutional right to due process and her duty to insure I was afforded procedural justice. (See Exhibit #1)

25. *** The issue of Judge Rogers changing the law to make the prosecution’s case as well as many other violations in this entire proceeding was in my Complaint of Misconduct in the 11th Circuit (#11-13-90067). After nearly 6 months the 11th circuit dismissed the complaint without addressing ANY of the issues raised. All documents are posted on many web sites (including www.2peter3.com and, I believe, www.freehovind.com) since thousands world wide are following the injustice in this case.

26. To make matters worse, after the jury verdict Attorney Heldmyer submitted a special jury instruction asking that all of the so-called “structured funds” (the ministry money withdrawn over a 2 year period 3-5 years earlier) be forfeited to the government even though she knew those funds were all donated to the ministry in lawful ways and had been spent long ago on legitimate ministry bills and that there was no lawful or logical reason for her to even ask that they be forfeited as “restitution.” She knew full well that restitution can only be imposed for certain violations of law and this case did not involve any of them.

27. Her call for restitution violated 5E1.1(a)(1) which provides restitution only if authorized under USC 1593, 2248, 2259, 2264, 2327, 3663, 3663A or 21 USC 853(q)-drug laws. There were no drugs in this case yet she purposely misled the jury and the court into thinking she had authority to ask for these ministry funds long spent to be forfeited. She did not do her duty of providing me due process by pointing out the obvious violation of the law nor did she object when the judge granted it but rather she is the one who instigated and participated in this fraud.

28. After trial and I was put in prison Michelle Heldmyer discovered that I do not own anything she could seize so she submitted a motion asking to seize the Church ministry properties instead. My attorney and the Church trustee submitted objections and demanding a trial or at least a hearing on the issue of property ownership as the properties were not mine or my wife’s. The judge let it sit on her desk for 7 months and then, with no trial or hearing, granted Heldmyer’s motion so the government could seize Church ministry property as restitution for this bogus “bill.” Shortly thereafter AUSA Atchison (paragraph #2 above) did seize the ministry bank account and then was arrested and hung himself.

29. Issue #3- Count #58 – obstructing and threatening an IRS agent

30. As the attached affidavit (Exhibit #2 p. 7) explains I had discovered that the IRS had me coded as an “underground coal miner in the Virgin Islands.” I immediately sent documentation to correct the record and then, to insure the IRS had the right records on me, I submitted a request under the Freedom of Information Act (FOIA) to see my corrected Individual Master File (IMF) that the IRS keeps on every individual. It was 710 pages and cost me $146 to get it. In that document were about 35 pages that clearly spelled out that I was NOT a tax protestor and owed NO tax! (see sample pages Exhibit #3). I can send all 35 pages if you need them.

31. During trial, in an attempt to convince the jury I had “impeded” the IRS in the performance of their duty (count #58) Attorney Heldmyer introduced my IMF as evidence that I had “caused the IRS a LOT of work to gather all that data for my FOIA!” She violated her duty to insure I received procedural justice by NOT telling the jury that I have a right to that information via a FOIA and that I had paid full price for it and that the IRS has a person on staff to answer FOIA requests. She also deliberately maliciously withheld all 35 pages of exculpatory evidence showing my innocence.

32. I followed the law to the letter yet she made it look to the jury like I was committing a crime by paying for the file the IRS keeps on me and that Congress says I am allowed to request!

33. At trial my attorney asked IRS Agent Scott Schneider about the IMF (Exhibit #4 p. 4-6) and without touching or looking through the stack of papers my attorney was holding (my IMF) Agent Schneider admitted that he knew those exculpatory pages were not there. This was even though it had been certified as a “true copy.” (p. 5)

34. The Supreme Court has clearly stated, “The United States Attorney is the representative…of a sovereignty…whose interest, therefore, in a criminal case is…that justice be done.” (Exhibit #1 p. 2) Attorney Heldmyer did NOT do her duty in my case!

35. When my attorney was trying to use these missing pages from the IMF to impeach the testimony of Agent Schneider the judge stopped his line of questioning and intimidated my attorney with a reminder that Agent Schneider was not on trial. He stopped pressing the point but Attorney Heldmyer not only knew of this deceit but originated it, orchestrated it and approved of it.

36. Rather than perform her duty of seeing justice done and that my rights were protected by agreeing with my attorney that the witness should be impeached at that point she was silent. She was determined to get a conviction by any means, lawful and ethical or not.

37. As for “threatening” anyone, here is the story: In April 2004 IRS agent Schneider led a Gestapo style Swat team raid of our Church ministry and seized 42+ boxes of ministry records and all the ministry cash on hand. He also interrogated all the staff for hours. The day after the raid I was doing my daily radio program on science and the Bible and a caller suggested I pray for them like David did for his enemies in the Bible. I prayed and asked God to protect us and for Him to handle those who came against us. Over two years later Michelle Heldmyer asked for an indictment telling the Grand Jury that I had threatened an IRS agent. On the witness stand my attorney asked Scott Schneider when I “threatened him” and he referenced the prayer on the radio. My attorney asked how a prayer on the radio can be a threat and Schneider responded with words to the effect that in the Bible God would often answer prayers like that by harming or even killing the individual prayed for. The Treasury Inspector General for Tax Administration (TIGTA) did a complete investigation and determined there was never a threat. (Exhibit #4 p. 2). Attorney Heldmyer knew there was no threat yet she violated her duty to seek justice and falsely charged me.

38. As the board responsible for admitting attorneys to practice in your court I ask that you investigate each item in this complaint and get Attorney Heldmyer to answer in writing for her unethical actions and misconduct and to issue sanctions and administer whatever discipline is appropriate. In order for Americans to have respect for the law the the justice system it is essential that conduct unbecoming a licensed attorney such as she exhibited in my case be punished and corrected and their license to practice law and represent the United States be revoked.

39. I swear under penalty of perjury that the above stated facts are true and correct to the best of my knowledge and belief.

_______________________

Kent Hovind 12-19-2013

Thanks! Share it with your friends!

Tweet

Share

Pin It

LinkedIn

Google+

Reddit

Tumblr