05/24/22

Analysis by Dr. Joseph Mercola

STORY AT-A-GLANCE

- Many are now starting to realize that we’re facing a multitude of catastrophes, sort of pancaked on top of one another

- Gas prices are skyrocketing, the crypto market recently cratered, the stock market is starting to cave and inflation is rapidly rising

- According to some financial analysts, our only choices now are prolonged inflation or a global economic meltdown

- In 2016, the World Economic Forum (WEF) published several “predictions” for the future that are now starting to take shape. This indicates the WEF is responsible for, and is carrying out, an agenda to fulfill its own predictions or wishes

- We have now passed over the energy cliff, and are rapidly approaching a situation in which there will be no surplus energy left over for society to function on. This is likely why all the globalist plans converge on the year 2030

In the featured video, Chris Martenson, Ph.D., reviews why he’s giving up on “the idea that our leaders in charge are going to get a clue and maybe navigate our way to a better … outcome.”

Many are now starting to realize that we’re facing a multitude of catastrophes, sort of pancaked on top of one another. Gas prices are skyrocketing, thanks to President Biden’s decision to shut down U.S. oil production,1 yet when confronted with the price hikes, he blames it on Russia’s invasion of Ukraine2 — an odd choice, considering Russia accounts for a mere 3% of U.S. crude oil imports.3

The crypto market recently cratered.4 Bitcoin lost about a quarter of its value and Luna, an algorithmic stablecoin, lost nearly all of its $40 billion value.5 It is likely this was precipitated by Blackrock and Vanguard as crypto is an existential threat to the financial markets. The crypto market in its entirety has lost more than half its value since November 2021, and Reddit forums are reportedly flush with suicide discussions.

The stock market is also starting to cave, and inflation is starting to careen out of control, thanks to the U.S. government borrowing (read printing) trillions of dollars from the Federal Reserve which, by the way, is not federal but a privately-owned corporation. The reason we pay federal taxes is because we have to pay interest on the money the federal government borrows from this private lender.

Ditching this central bank, i.e., the Federal Reserve, and printing our own U.S. currency would keep inflation at bay, since the central bank system only has a life span of about a half-century. Then, it collapses under the weight of the accrued debt. The interest is simply too great to ever be paid off.

So, it’s important to realize that the collapses of energy and finance we’re about to experience are not accidental. Parts are intentional and fabricated, and other parts are unavoidable thanks to relinquishing our national currency creation to a central bank.

Uncontrolled Crash Appears Inevitable

We’re now faced with nothing but painful options. As reported by Spanish economist and investment manager Daniel Lacalle:6

“After more than a decade of chained stimulus packages and extremely low rates, with trillions of dollars of monetary stimulus fueling elevated asset valuations and incentivizing an enormous leveraged bet on risk, the idea of a controlled explosion or a ‘soft landing’ is impossible.

The first problem of a soft landing is the evidence of the weak economic data … both the labor participation and employment rate … have been stagnant for almost a year … Real wages are down, as inflation completely eats away the nominal wage increase.

According to the Bureau of Labor Statistics, real average hourly earnings decreased 2.6%, seasonally adjusted, from April 2021 to April 2022. The change in real average hourly earnings combined with a decrease of 0.9% in the average workweek resulted in a 3.4% decrease in real average weekly earnings over this period …

The second problem of believing in a soft landing is underestimating the chain reaction impact of even allegedly small corrections in markets. With global debt at all-time highs and margin debt in the US alone at $773 billion, expectations of a controlled explosion where markets and the indebted sectors will absorb the rate hikes without a significant damage to the economy are simply too optimistic …

However, the biggest problem is that the Federal Reserve wants to curb inflation while at the same time the Federal government is unwilling to reduce spending.

Ultimately, inflation is reduced by cutting the amount of broad money in the economy, and if government spending remains the same, the efforts to reduce inflation will only come from obliterating the private sector through higher cost of debt and a collapse in consumption …

There is no easy solution. There is no possible painless normalization path … There are only two possibilities: To truly tackle inflation and risk a financial crisis led by the US dollar vacuum effect or to forget about inflation, make citizens poorer and maintain the so-called bubble of everything … [Federal reserve chairman Jerome] Powell will have to choose between the risk of a global financial meltdown or prolonged inflation.”

World Economic Forum Has Told Us Their Plan

In 2016, the World Economic Forum (WEF) published several “predictions” for the future, a sort of summary agenda to let people know the direction of the globalists’ plans. This was done in two formats. One was a video (above), which was also discussed in greater detail on the WEF’s website,7 the other was an article written by an unnamed WEF contributor, published in Forbes magazine.8

Topping the WEF’s list of “predictions” for 2030 was that “you will own nothing and be happy.”9,10 As noted by Martenson, if you own nothing, that means you’ll be renting everything you need.

And if you’re renting, that means you’re renting it FROM someone (and note they didn’t say “we” will own nothing). While the WEF didn’t spell out who the owner of everything would be, it’s clear they foresee a future in which ownership of everything is restricted to a few “elite” individuals — the richest of the rich, and the most powerful of the powerful.

This is what The Great Reset, “Building Back Better” and the Green New Deal are all about. It’s about wealth transfer, from you to them. It’s about stripping property rights from the people. It’s about controlling the masses, and possibly eliminating a few along the way to ensure the “useless eaters” don’t gobble up “their” resources.

While the first item on the WEF’s wish list is disconcerting, Martenson is even more troubled by No. 8 on the list, which states that by 2030, “Western values will have been tested to the breaking point.”

Just what are “Western values”? Martenson suggests cornerstones include things like individualism, liberty, democracy, science and progress, the bond between parent and child, family values and the idea that there is objective truth based on shared, common understanding of facts.

Certainly, the idea of objective truth has been stretched to near-breaking over the past two years. Martenson notes he can’t even have conversations with some colleagues anymore because they can no longer agree on the common interpretation of common data. “We don’t share objective reality anymore,” he says.

Whodunit?

Now, if the WEF claims they’re going to do something, and it then happens, is it not reasonable to suspect the WEF had a hand in it? Martenson certainly believes so. The fact that we’re now experiencing the destruction of Western values on every front suggests the WEF and its global allies are, in fact, carrying out their plan.

Here’s another example: Also included in the WEF’s 2030 “wish list” is the declaration that “You’ll eat less meat.” This too is now coming to pass. And, by the way, meat shortages, which are bound to become far more severe over the next several months and years, are largely the result of intentional actions by national and international leadership.

Martenson points out that we’re now seeing plenty of evidence of “enemy action,” meaning, what we’re experiencing is not the result of mere incompetence but, rather, intentional malevolence.

“There are people out there INTENDING to destroy the country,” he says. “And like Maya Angelou, the poet, said, ‘When people tell you who they are, believe them the first time.’ It’s a really good life tip.”

The Hubris of Wealth

Martenson goes on to note that one of the things that strikes him about “the WEF crowd” is that their superiority complex appears to be rooted in their wealth. Because they’re wealthy, they believe they’re smarter than the rest of us and worthier of life than we are.

However, their wealth has also shielded them from the realities that face the rest of us, so many actually have only the flimsiest understanding of how things work. “They’ve never had to cook a meal, bang a nail or run a production process,” Martenson says. Yet these are the people who now want to micromanage the lives of every person on the planet.

The Looming Energy Crisis

But what is it about the year 2030? Why do all of the globalist plans converge on 2030? What’s the urgency, the ticking clock that has them so intent on reaching certain goals by that time? “Wander with me over to the big world of resources and I’ll think you’ll see what the big ticking clock is,” Martenson says.

Basically, the short story is that the resources of the world have been grossly mismanaged under the leadership of these globalists, and we’re coming up on very real shortages. Up until about 1930, farming was a net positive exercise. Today, it’s a net negative process. We’re using more energy in the production of food than we get out of it.

To give you a bit of background, Martenson is the founder of a website called Peak Prosperity, and he’s the author of a book and corresponding course called “The Crash Course.” It lays out a systems-level view that connects economy, energy and environment into a holistic whole. You cannot squeeze any one of these without causing ramifications in one or both of the others, and we’re starting to see very clear examples of this now.

However, rather than admit their mistakes, and the mistakes of their forefathers, the globalist cabal members are now trying to manipulate the world into a system of governance that will allow them to maintain their power and privilege while the rest of us are told to “take cold showers and eat bugs,” Martenson says.

The NOPEC Bill

You’ve likely heard about OPEC, the Organization of the Petroleum Exporting Countries, an intergovernmental organization of 13 countries founded in 1960. The U.S. Senate judiciary committee recently passed the NOPEC bill, which paves the way for lawsuits against OPEC members for market manipulation — an action that OPEC energy ministers warn could drive oil prices to $300 per barrel.

That would basically be the death knell for the U.S. economy. Many companies would simply go out of business. It’s important to realize that for all the talk about green energy, oil is the engine that drives economies and food production.

U.S. leaders are now cutting the U.S. off from oil, while having no reasonable alternative, while Saudi Arabia is forming alliances with Russia and China. Martenson believes the power structure of the world will dramatically change over the next decade, and he who has the oil will rule the roost.

It’s not an unintended consequence if you can predict the future based on certain data, and Martenson predicts the NOPEC bill will open the door for OPEC to retaliate in kind and find new trading partners who aren’t so eager to sue them. If that happens, and the U.S. economy tanks as a result, it’s hardly an unintended consequence but a predictably negative outcome, based on the intentional actions of our leadership.

Energy Is the Economy

Martenson goes into a number of other details that explain why and how we’re heading toward a global energy shortage, but that’s the final verdict: The countries of the world will not have the energy they need to maintain rates of production, which includes food production.

Data clearly show that consumption of primary energy (hydropower, nuclear energy, gas, coal, oil) and the real gross domestic product (GDP) is so tightly intertwined as to be indistinguishable. They go together and cannot be separated.

If you want more units of a given product, you have to consume the same number of units of primary energy. So, “energy is the economy,” Martenson says. Take away the energy and the economy vanishes. You’d be hard-pressed to find a single item in your home that ended up inside your house without the use of a primary energy source, and oil in particular.

What this means for our immediate future is that we’re at a point that requires painful trade-offs,11 but our leadership simply aren’t willing to do it, or don’t have the experience to realize that trade-offs are necessary.

The dire conclusion Martenson presents is that our energy economy is in a nose dive. Importantly, it’s not just about quantity. Even if we were able to extract more energy, such as oil, on a global level, which we can’t, it still might not solve the problem, and here’s why.

Energy Return on Investment

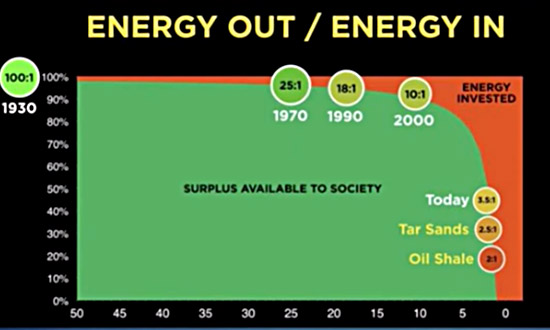

The graph above was taken from Martenson’s video above. It shows the energy return on investment over the past several decades. Energy is required to bring energy to market. Energy is required to pump oil out of the ground, for example. The energy required by the energy industry itself is the red part in the graph.

In the 1930s, we’d invest one barrel of oil into an oil extraction venture, and get 100 barrels back. The green part of the graph shows the surplus energy available to society. With that surplus, society can do whatever it wants. This surplus is what has allowed for air travel, massive gas-guzzling SUVs, vacations, a home filled with electronics and much more.

But as you can see, the energy invested in more recent years ballooned, which means the surplus energy available to society has shrunk, but it didn’t shrink linearly. In 2000, when energy production required the input of one barrel to extract 10 (or one unit of energy to produce 10 units of energy), there was still a lot of surplus. It wasn’t noticeably different from the 1970s, really.

But look where we are today. We’ve now gone over what’s called “the energy cliff,” and at the bottom of this cliff, there’s no surplus energy left over for society, because it takes one unit of energy to produce a unit of energy. Today, the energy to produce oil is about one unit for every 3.8 units, leaving only 2.8 units for society. Tar sands and oil shale have about the same returns. Needless to say, as energy becomes in short supply, prices will rise.

To understand these concepts better, I recommend viewing Martenson’s video. So, in the final analysis, it appears only the foolish will ignore the signs of the times and hang their hopes on the fantasy that, somehow, all of this will just sort itself out and life will return to normal. That hardly seems likely. As noted by Martenson, there’s a reason why the global cabal are pressing forward with 2030 in their sights. They know we’re on the energy cliff and where we’re headed.

The question is, how do we make it through the coming energy and financial crises? The answer is to work on your own resiliency. Learn to grow your own food. Start now, because it can take some time to master. Pick up tips from preppers who can instruct you on long-term food storage and the like, and pick up a bit extra right now.

Consider how you might power some of the essentials in your home if there are rolling blackouts. Identify sources of potable water and so on. Like Martenson warns, I believe things will get far worse before they get better, and making things better again may require new forms of energy that haven’t even been invented yet, or at the least released into the public domain.

Thanks! Share it with your friends!

Tweet

Share

Pin It

LinkedIn

Google+

Reddit

Tumblr